Welcome to an in-depth exploration of the monumental shift Tesla is about to unleash with its Robotaxi program, a transformative leap that redefines the company’s business model and the entire transportation industry. This article dives deep into the insights shared by Tesla experts and enthusiasts, revealing why TSLA’s Robotaxi is not just about competing with Uber—it’s about making Uber obsolete and revolutionizing how we think about vehicle ownership, recurring revenue, and autonomous driving.

From stock market analysis to the technological and regulatory hurdles, and from the potential impact on global automakers to the future of Tesla’s humanoid robots and drone technology, this comprehensive guide covers every angle of Tesla’s bold new frontier. Buckle up as we unpack the implications of Tesla’s Robotaxi rollout and what it means for investors, consumers, and the automotive industry at large.

Table of Contents

- 🚗 The Stock Market Reaction and TSLA’s Current Position

- 💡 Understanding the Robotaxi Revolution: From Car Sales to Recurring Revenue

- 🛑 Overcoming Doubters and Regulatory Challenges

- 📈 The Growth Timeline: From Pilot to a Thousand Robotaxis

- 🌍 Global Opportunities and OEM Licensing: The Bigger Picture

- 🤖 Tesla’s Technological Moat: Why Copying FSD is Nearly Impossible

- 🌐 International Markets: The Role of China, Europe, and Asia

- ⚖️ The Competitive Landscape: Uber, Waymo, and Beyond

- 🤖 Beyond Robotaxi: Tesla’s Humanoid Robots and Drone Ambitions

- ❓ Frequently Asked Questions (FAQ) about TSLA Robotaxi and Future Technologies

- 🔮 Conclusion: The Dawn of a New Era with TSLA Robotaxi

🚗 The Stock Market Reaction and TSLA’s Current Position

TSLA’s stock has experienced significant volatility, reflecting the market’s attempt to digest the magnitude of Tesla’s upcoming Robotaxi transformation. As of the last analysis, the stock rose from about $278 to a peak near $362 before settling back to around $285. This rollercoaster ride encapsulates investor excitement but also nervousness due to geopolitical tensions, such as saber-rattling between Iran and Israel, which impact broader market sentiment.

Technical analysis shows that the stock remains above its 200-day moving average, a bullish indicator. However, the market’s nervousness is palpable, compounded by new uncertainties and external geopolitical influences causing many investors to sit on the sidelines.

James from Invest Answers pointed out that Wall Street often struggles to model revolutionary business changes like Tesla’s Robotaxi rollout, given it upends traditional consumer goods frameworks. The transition from car sales to a massive recurring revenue model with high margins is unprecedented, challenging conventional valuation methods.

Soren Basher emphasized that the recent fluctuations are largely reactions to short-term political drama and that the real excitement lies in positioning portfolios for the long-term economic impact of Robotaxi. Meanwhile, Alexandra Merz, also known as Tesla Boomer Mama, is focused on the medium to long-term picture, viewing short-term stock moves as noise while keeping her eyes on the transformational potential of Tesla’s new business model.

💡 Understanding the Robotaxi Revolution: From Car Sales to Recurring Revenue

At the core of Tesla’s Robotaxi launch is a seismic shift in business strategy: moving away from traditional car sales toward a recurring revenue model powered by autonomous ride-hailing. This model eliminates human drivers, reduces costs, and promises massive profit margins by turning Tesla vehicles into self-driving taxis that generate income 24/7.

This transition is not just about beating competitors like Uber; it’s about rendering them obsolete. When Tesla flips the switch on Robotaxi, the company transforms overnight. Instead of relying on new car sales, Tesla will operate a fleet of autonomous vehicles, collecting revenue per mile driven.

As Alexandra highlighted, this shift will take time for Wall Street and the broader public to fully grasp and appreciate. Investors may initially be wary, waiting for the first mishaps or regulatory hiccups, but the long-term economic implications are profound. Tesla’s model offers scalable, margin-rich revenue streams that could dwarf traditional automotive sales.

James adds that Tesla’s vast moat in autonomous driving technology, combined with its fleet size and data advantage, makes it an unbeatable force. Retail investors currently front-run hedge funds by buying dips confidently, positioning themselves to reap the benefits of this revolution before Wall Street fully understands it.

🛑 Overcoming Doubters and Regulatory Challenges

The road to Robotaxi rollout is not without skepticism and challenges. Critics argue the rollout is delayed, the initial fleet is too small, and there are concerns about safety, vandalism, and regulatory hurdles. There are even reports of organized protests funded by critics like Dan O’Dowd, who have launched campaigns against Tesla’s autonomous technology.

However, Tesla’s approach to starting small—with a limited number of vehicles closely monitored—helps mitigate many risks. This “soft launch” strategy ensures any issues are ironed out without widespread public impact. The company can quickly replace vandalized vehicles because the Robotaxi fleet consists of regular Model Ys, which Tesla can easily swap in and out.

Furthermore, Tesla’s vehicles are equipped with multiple cameras, providing real-time surveillance that deters vandalism and captures incidents, protecting both the company and passengers.

From a regulatory perspective, while federal approval remains a concern, individual states like Texas and cities such as Austin are moving quickly to permit autonomous vehicle operations. Tesla’s choice of Austin for the initial rollout is strategic, given the supportive regulatory environment and local government backing. The expectation is that once Texas and California approve Robotaxi operations, federal approval will follow.

Elon Musk’s cautious approach, emphasizing safety and reliability, means that although the rollout may be slower than some hope, it is designed to succeed sustainably.

📈 The Growth Timeline: From Pilot to a Thousand Robotaxis

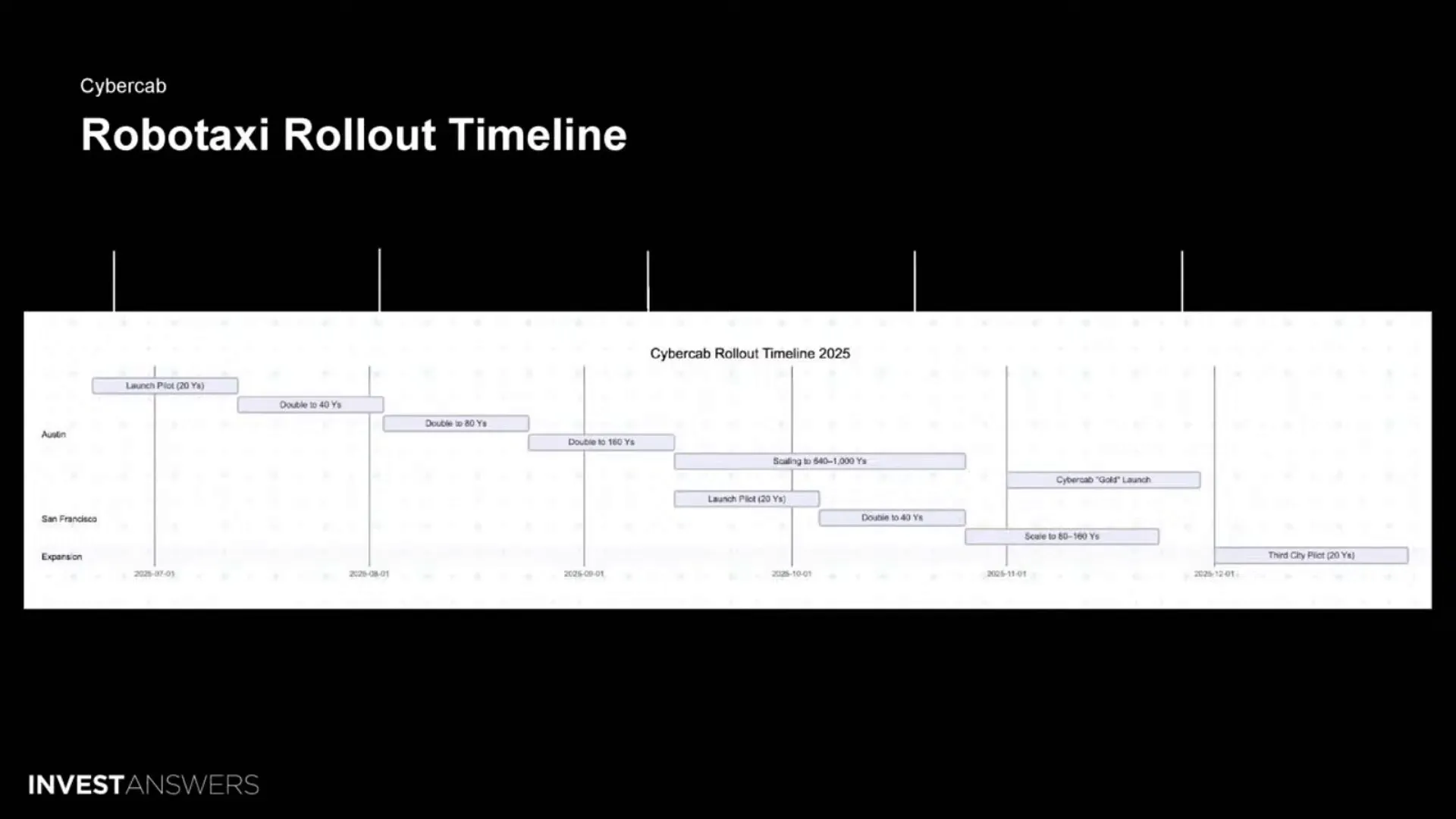

Experts have projected a potential timeline for Tesla’s Robotaxi expansion. Starting with 10-20 vehicles in Austin, Tesla could ramp up to 40, then 80, 160, 640, and possibly 1,000 Robotaxis by the end of the year. Following Austin, other cities like Scottsdale in Arizona or additional Texas cities could follow a similar or even faster rollout pace.

However, the key to this rapid scaling is Tesla’s confidence in the system’s safety and reliability. Once Tesla confirms that its vehicles can operate autonomously without the need for a safety driver or follow car, ramping up will accelerate dramatically.

James and Soren both stress the importance of Tesla taking the time needed to perfect the technology and infrastructure. They liken the initial phase to a “soft opening” in retail, where Tesla learns and adjusts before a full-scale launch.

Meeting demand is critical; if customers experience long wait times, they may revert to traditional ride-sharing services. Tesla must ensure enough vehicles are available to satisfy early demand and generate positive user experiences.

🌍 Global Opportunities and OEM Licensing: The Bigger Picture

Beyond the Robotaxi fleet itself, Tesla’s Full Self-Driving (FSD) technology holds enormous potential as a licensing platform for other automakers worldwide. The idea is that Tesla could license its FSD software to established car manufacturers, enabling them to offer autonomous vehicles without having to develop the technology in-house.

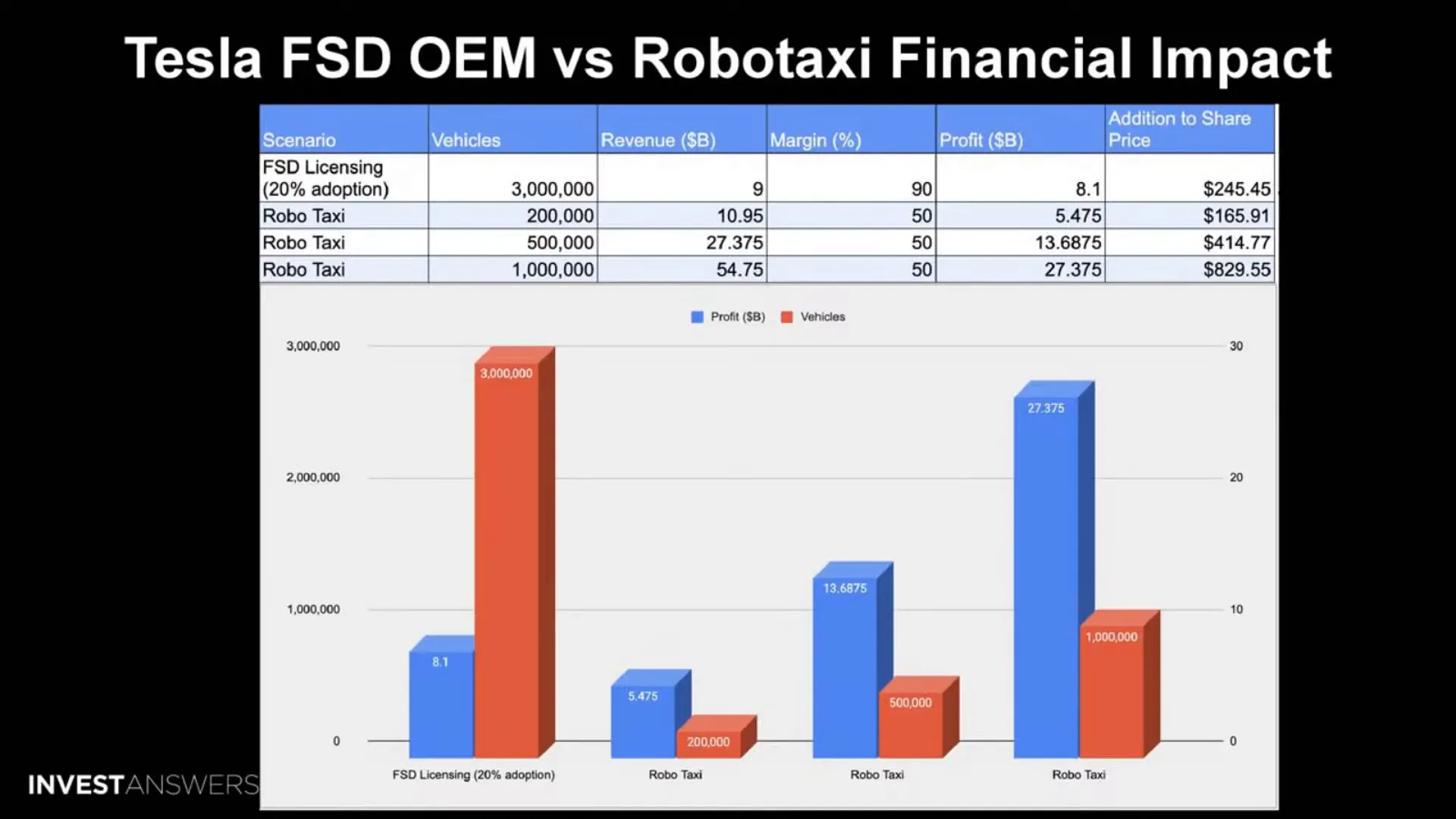

This licensing opportunity could dwarf the Robotaxi revenue. For example, if Tesla licenses FSD to three major OEMs with 20% adoption across their combined production of three million vehicles, at a $3,000 fee per car, Tesla could generate $9 billion in revenue with 90% profit margins, translating to a potential $245 increase in share price.

In comparison, a fleet of 200,000 Robotaxis, which might take two years to achieve, represents an $11 billion opportunity but with only 50% margins. Hence, OEM licensing could be the more lucrative and transformational opportunity for Tesla.

However, Tesla plans to be selective in licensing deals, focusing on EV manufacturers and requiring significant upfront payments that could reach billions, ensuring serious partners and maximizing shareholder value.

🤖 Tesla’s Technological Moat: Why Copying FSD is Nearly Impossible

Tesla’s FSD technology is protected by an immense competitive moat. Unlike traditional software, Tesla’s neural networks are trained on billions of miles of real-world driving data collected from millions of Tesla vehicles worldwide. This vast dataset, combined with Tesla’s proprietary hardware and data centers, creates a barrier that is nearly impossible to replicate.

Attempts to reverse engineer Tesla’s software by buying vehicles or poaching employees have been met with legal action, underscoring Tesla’s vigilance in protecting its intellectual property.

Experts compare the complexity of Tesla’s neural networks to a shredded bag of code—impossible to piece back together without the original training data and infrastructure. Tesla continues to invest heavily in compute resources and AI research, recently announcing plans to build a model with four times the parameters of their current system, raising the bar for competitors.

While breakthroughs in AI could emerge, Tesla’s head start and continuous improvements mean it will likely maintain its leadership position for years to come.

🌐 International Markets: The Role of China, Europe, and Asia

The global rollout of Robotaxi and FSD licensing presents unique challenges and opportunities in different markets.

China, despite its massive size, presents a complex case. Labor costs are low, reducing the immediate economic incentive for Robotaxis. However, Tesla’s FSD vehicles have demonstrated remarkable capabilities in China’s challenging environments, and there is a growing market for autonomous vehicles among Chinese consumers.

Europe faces regulatory hurdles, with authorities slow to approve supervised FSD. Tesla’s administrative center in the Netherlands plays a crucial role, as approval there could unlock EU-wide access. Advocacy efforts are underway to pressure European regulators to expedite autonomous vehicle approvals.

South Korea and Japan represent lucrative markets where autonomous driving could thrive due to higher labor costs and dense urban environments.

⚖️ The Competitive Landscape: Uber, Waymo, and Beyond

While Tesla’s Robotaxi threatens to disrupt existing ride-sharing giants like Uber, the reaction from these incumbents is mixed. Some argue for protections to shield Uber from competition, but many analysts see this as ironic given Uber’s own disruption of traditional taxis.

Tesla’s fleet advantage, combined with lower costs and superior technology, positions it to outcompete rivals. Waymo’s specialized and expensive autonomous vehicles pale in comparison to Tesla’s scalable Model Y-based Robotaxis.

Tesla’s slow and stealthy rollout strategy minimizes risks of orchestrated sabotage or negative PR events, which competitors might struggle to counter.

🤖 Beyond Robotaxi: Tesla’s Humanoid Robots and Drone Ambitions

Tesla’s ambitions extend far beyond Robotaxis. The company is actively developing humanoid robots (Optimus) designed initially for factory and commercial applications before personal use. Experts predict personal humanoid robots will become commercially available around 2028, though safety and regulatory hurdles remain significant.

Additionally, Tesla is believed to be developing drone technology, potentially for military and civilian applications. Elon Musk has emphasized the strategic importance of drones, noting their power relative to jets and their role in modern warfare deterrence.

While SpaceX has declined some military contracts, Tesla’s manufacturing prowess could make it a leader in drone production, further diversifying its technological portfolio.

❓ Frequently Asked Questions (FAQ) about TSLA Robotaxi and Future Technologies

Q1: When will Tesla’s Robotaxi be available for public rides nationwide?

A1: Tesla aims for a tentative rollout starting June 22, with public ride availability expected to ramp up gradually. Full nationwide availability is anticipated by late 2025 or early 2026, depending on regulatory approvals and safety validations.

Q2: Will individuals be able to purchase Tesla’s Cybertruck-based Robotaxis?

A2: Initially, the yellow and golden Cybertruck Robotaxis will not be available for individual purchase. Tesla plans to sell these vehicles primarily to fleet operators. Private ownership of Robotaxis may become possible a year or two after the initial fleet rollout.

Q3: How will Tesla prevent vandalism and sabotage of Robotaxis?

A3: Tesla’s vehicles are equipped with extensive cameras and monitoring systems. The company can geofence high-risk areas, remotely control vehicle operations, and quickly replace damaged vehicles. Insurance will cover most vandalism-related repairs, minimizing operational impact.

Q4: What are the biggest risks to Tesla’s Robotaxi rollout?

A4: The primary risks include regulatory delays, potential technical mishaps during early rollout, and orchestrated protests or sabotage. Tesla’s cautious, phased rollout and strong legal protections help mitigate these risks.

Q5: How does Tesla’s FSD licensing model impact the automotive industry?

A5: Tesla’s FSD licensing could disrupt traditional automakers by providing them with ready-made autonomous driving software, potentially saving struggling OEMs and accelerating the shift toward autonomous EVs. However, adoption timelines may vary by region and manufacturer.

Q6: Is Tesla planning to merge with XAI (Elon Musk’s AI company)?

A6: While some speculate about a Tesla-XAI merger, experts believe Elon Musk prefers to keep the companies separate to maintain control and reduce regulatory complexity. The chance of a merger in the near term is considered low.

Q7: What is Tesla’s competitive advantage in AI and autonomous driving?

A7: Tesla’s advantage lies in its massive fleet generating real-world driving data, proprietary AI hardware, continuous software updates, and a deep commitment to in-house development. This creates a moat that is difficult for competitors to breach.

Q8: How will Tesla’s Robotaxi impact traditional ride-sharing companies like Uber?

A8: Tesla’s autonomous Robotaxi fleet is expected to disrupt Uber and similar companies by offering lower-cost, more efficient rides without drivers. This could force Uber to adapt or face obsolescence in major markets.

Q9: Will Tesla’s humanoid robots be available for home use soon?

A9: Tesla’s humanoid robots are initially targeted at commercial and factory use. Personal home robots are unlikely to be widely available before 2028 due to safety and technical challenges.

Q10: Is Tesla involved in drone technology?

A10: Yes, Tesla is believed to be developing drone technology, potentially for military and civilian applications, leveraging its robotics expertise and manufacturing scale.

🔮 Conclusion: The Dawn of a New Era with TSLA Robotaxi

Tesla’s Robotaxi program represents a paradigm shift not only for the company but for the entire transportation and automotive industries. By transitioning from car sales to a scalable, high-margin recurring revenue model, Tesla is poised to redefine how we move, invest, and think about vehicle ownership.

Despite skepticism, regulatory challenges, and external risks, Tesla’s cautious yet ambitious rollout strategy, combined with a deep technological moat and visionary leadership, make the Robotaxi a game-changer. The potential for FSD licensing to OEMs worldwide further amplifies Tesla’s opportunity, positioning it as a software powerhouse in addition to an automaker.

As Tesla continues to innovate with humanoid robots, drones, and AI integration, the future looks brighter than ever for TSLA investors and technology enthusiasts alike. The revolution in autonomous transportation is not coming—it’s already here, and Tesla is leading the charge.

Stay informed, stay patient, and be ready for the exciting journey ahead with Tesla’s Robotaxi and beyond.

Great TSLA Blog!

Check out this really cool thing